Interview with Cassie Young, GP and go-to-market executive at Primary VC.

Introduction

Like most great venture capitalists, Cassie Young is an operator turned investor. She’s not only GP at Primary Venture, she’s also a fractional go-to-market executive, helping Primary’s portfolio companies with building and executing their GTM strategy. This is part of Primary’s unique model of a Portfolio Impact Team that works closely with their portfolio companies.

Primary Venture Partners is a New York-focused seed-stage venture capital firm that provides multi-dimensional support to its portfolio companies, helping them accelerate their growth path to Series A. They have 70 active portfolio companies and a billion dollars in assets under management. Primary was started by serial entrepreneur Brad Svrluga and Ben Sun.

There are three main hurdles founders have to jump in the seed stage:

- Building the right team

- Securing customers

- Creating a compelling story for downstream capital

Cassie zeros in on the task of securing customers, mapping out these four strategies:

- Qualify Leads with BANT

- Stay on the Path to Close with MEDDPICC

- Caluclate How Much Pipeline Coverage You Need

- Hire the Right Sales Leaders at the Right Time

1. Qualify Leads with BANT

Most founders run into the problem of having a sales call then the lead going dark. Cassie finds that this is most often a result of not fully qualifying a lead. Deal qualification, especially while in the Seed stage, can be optimized when you use the framework BANT (Budget, Authority, Need and Timing). Make sure your lead has answered these questions. They need a budget, decision making authority, and a real problem that you can solve. Timing means, for example, they can’t be locked into a three-year contract with a competitor.

If your lead has 3 out of the 4, they’re well qualified.

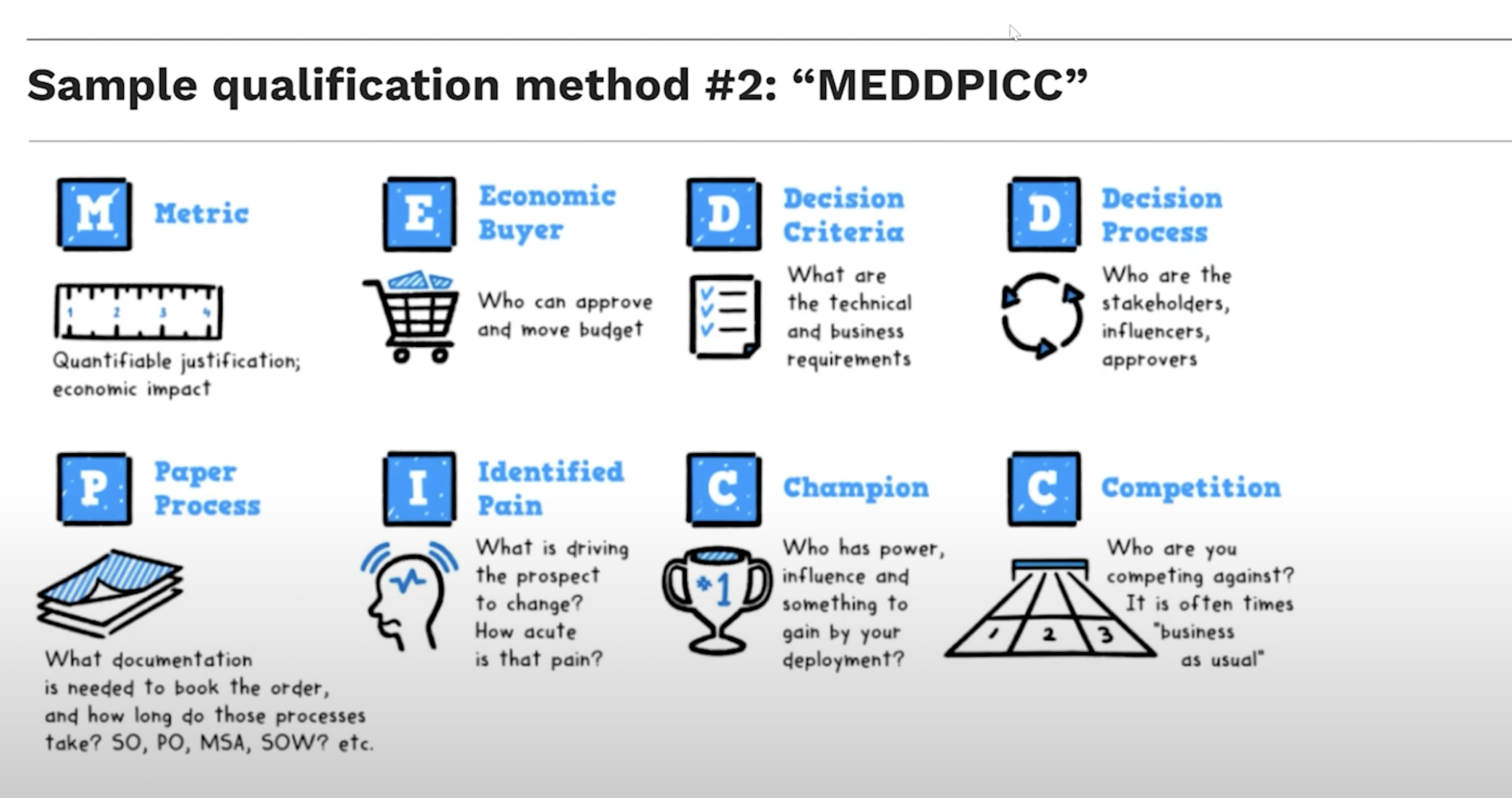

2. Stay on the Path to Close with MEDDPICC

This framework is to help founders make sure that their deal is tracking to close.

- Metric - Do we understand the business case and ROI metric the lead is trying to solve?

- Economic Buyer - Who ultimately approves the budget? (The “authority” part of BANT).

- Decision - What is the decision criteria and who is involved in the buying process? Who is involved, what does the buying process look like?

- Paper Process - Is a purchase order required?

- In-the-Eye Pain - Understand the pain points.

- Champion in C-Suite - Identify key stakeholders.

- Competition - Understand the competition.

Founders should have a spreadsheet to track their progress with MEDDPICC. This is most helpful for mid-market and enterprise sales motions. If you’re lacking in any one of these, it creates challenges in getting the deal done.

3. Calculate Much Pipeline Coverage You Need

How much pipeline do you really need to hit your target sales? It’s an easy math equation - one divided by your win rate.

If you have a 25% win rate, you need 4x coverage in opportunities (pipeline). If you have a 10% win rate, it’s 10x, but you're probably not selling into the ideal customer profile in the first place.

Don’t forget to consider your sales cycle length of time, because it takes time to develop pipeline. In the early days of customer building, founders are keen to get the whales (the enterprise company), but that takes time. Growth stage companies should balance those efforts with finding pockets of customers that can move faster so you’re closing deals and getting case studies.

4. Hire the Right Sales Leaders at the Right Time

You do not need a CRO at the Seed stage. Seasoned sales leaders want a team in place, which you won’t have at this stage. Consider pipeline coverage when deciding to hire a BDR (business development representative), SDR (sales dev rep), or account executive. If you don’t have a lot of opportunities in your pipeline and you’re still honing in on your ideal customer profile, hire a BDR first. Once you become overloaded with sales calls, then you can start hiring a specialist.

Your very first sales hire should be excited about building process and have an appreciation for going zero to one.

Finally, an interview tip - ask candidates, "If we hire you and a year from now things don't work out, what's your best guess as to why not?" to get an understanding of where things might go.

Closing: What makes a billion-dollar business?

Many billion-dollar companies have followed the growth pattern of “Triple Triple Double Double Double” or 3 3 2 2 2. Cassie sees more nuance than this, an idea that was explored in Battery Ventures’ 2015 paper about software companies that became billion-dollar businesses.

This pattern of growth at warp speed isn’t always the case. For example, Alloy, a fintech company with a $1.5B evaluation, took years to find their footing and didn’t have all of the answers out of the gate. For the right team and market, Primary Ventures takes early risks and takes the time to help build their portfolio companies to billion-dollar businesses. A relentless focus on people and recruiting excellence is the difference between good and great.

Head to Inside’s Startup Community to learn, share, and network with other founders.