Private Equity is More Common Than You Think

Most of the businesses you interact with daily, from your dentist to your child’s daycare to your condo complex, may be owned by a private equity group.

Private equity takes many forms, and whether you're a business owner or investor, you’ll benefit from understanding the nine main types of private equity.

What is Private Equity?

Many forms of private equity, like venture capital, are known for making long-term investments in companies that are early-stage, high-risk, and tech-focused.

Private equity is typically only available to accredited investors, or institutional investors, and qualified clients like high net-worth individuals. Minimum investments can be as low as $25K or as high as $25M. Capital stays locked up for a while, usually 3-10 years minimum. For PE investors, this is a way to possibly make a higher return per unit of risk and avoid the volatility of the public markets.

The Goal of Private Equity

The simple equation is:

- Enter

- Seek to improve

- Exit

Another way to put this:

- Buy low

- Grow fast

- Sell high

There are many ways a startup can exit. Exits can happen through an acquisition or IPO. There’s also the option of a SPAC - a “special purpose acquisition company,” - a strategic alternative to an IPO. A SPAC is a shell company listed on the stock exchange with the purpose of acquiring a company. In a SPAC deal, the acquired company doesn’t have to go through the IPO process or comply with the regulations of that process.

Not all companies exit. A company may end by dissolving, liquidating, filing for bankruptcy, or becoming insolvent (forced to close due to the inability to pay debts).

The 9 types of private equity:

- Venture Capital

- Angel Investing

- Real Estate Private Equity (REPE)

- Infrastructure

- Fund of Funds

- Mezzanine

- Distressed Funding

- Leveraged Buyout (LBO)

- Secondary

How do they all work?

- Venture Capital (VC) - Venture Capitalists provide capital to startups and early-stage companies with high growth potential in exchange for equity ownership. The investors on Shark Tank are VCs.

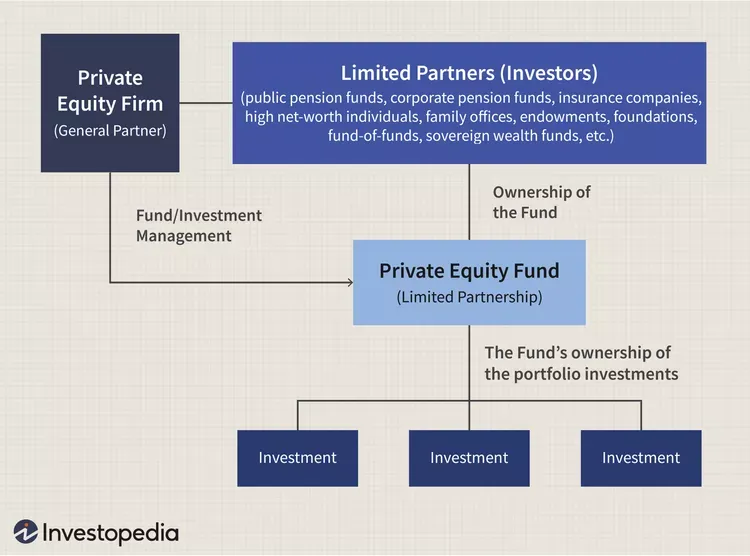

Venture capitalists can be part of a firm, fund, or syndicate. A VC fund typically includes General Partners (also called GP’s, MP’s or Directors) who run the fund and Limited Partners (LPs) who contribute most of the capital to the fund.

VCs are usually prepared to take higher risks than other types of investors, as they seek large returns from the growth of the invested companies. Saas is traditionally one of the most popular VC investment categories because of its large total addressable market (TAM) and ability to scale quickly and exponentially.

Traditionally, venture capitalists provide early funding rounds - Pre-Seed, Seed, Series A, B, and C. Once a fund makes a Series C investment and beyond, this is considered Growth Equity, which focuses on acquiring and managing mature, profitable companies

- Angel Investing - An angel investor is an affluent individual who invests their own money into startups. Like in venture capital, they focus on are early-stage, high-risk companies that could grow to deliver 100x returns, although the likelihood of this is low. Like VC, angel investors usually take minority ownership in the company. Unlike VC, Angel investors are not part of a larger fund or organization.

- Real Estate Private Equity (REPE) - While most forms of private equity invest in companies, a huge subset of private equity funds make large real estate investments. Like venture capital, a real estate fund could take the form of an individual investor, a syndicate that aggregates investors, or a fund of funds, all with the goal of turning a profit through large real estate investments.

- Infrastructure - While a Real Estate funds invest in properties, infrastructure funds invest in essential utilities or services like:

- Utilities (gas, electricity, water)

- Transportation (airports, roads, bridges)

- Social infrastructure (hospitals, schools)

- Energy (power plants, pipelines)

- Renewable energy (solar power plants, wind farms)

- Fund of Funds - Instead of investing in companies, a “fund of funds” invests in the portfolios of other private equity funds.

- Mezzanine Capital - Also called mezzanine financing. Typically a hybrid of debt and equity, blending features of both traditional loans and investments. Mezzanine capital is higher risk than traditional debt, but also offers a higher potential return than equity investments. Companies that pursue mezzanine capital need additional capital but don’t want to issue more equity or take on more debt.

- Distressed Funding - A distressed private equity fund takes control of a business during bankruptcy, financial distress, or restructuring. They buy at a low price in hopes of making the business profitable and selling it.

- Leveraged Buyout (LBO) - LBO funds are used to acquire companies by taking on debt to finance the purchase. The investors use borrowed money instead of their own. They use debt (leverage) to finance a purchase and use the acquired company's assets as collateral. The new owners of the company hope to make enough profit from the company's operations to pay back the borrowed money and still make a profit for themselves.

- Secondary - If an investor wants to take their money out of a long-term investment before the previously agreed-upon time period , the secondary market is the only way to do it. They sell their investment to another investor.

Remember, investing always involves risk, so if you seek the potential profits of investing in private markets, make sure you only invest what you can afford to lose.

Learn more about venture capital at https://inside.com/vc.