Building in today’s market as a startup founder is as promising as it is daunting.

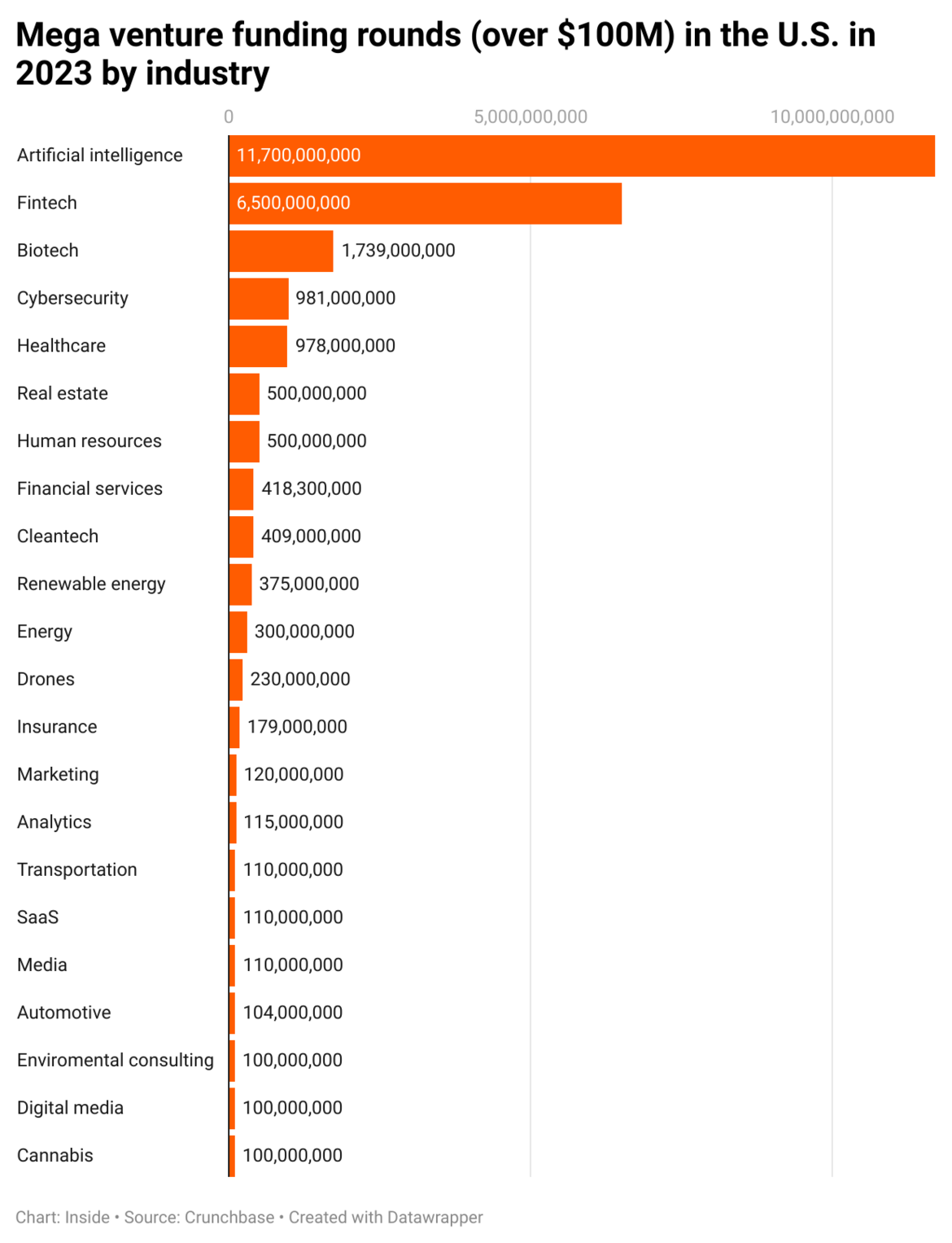

On one hand, cutting-edge technology like Generative-AI has breathed life into startup funding and opened the door to hundreds of new ideas for first-time founders. In fact, despite a general decline in VC funding in Q1 2023, AI companies continued to attract significant investment – accounting for 19% of all investment dollars last quarter. AI has been the bright spot in 2023, with new startups emerging every day to create AI-driven efficiencies for their customers.

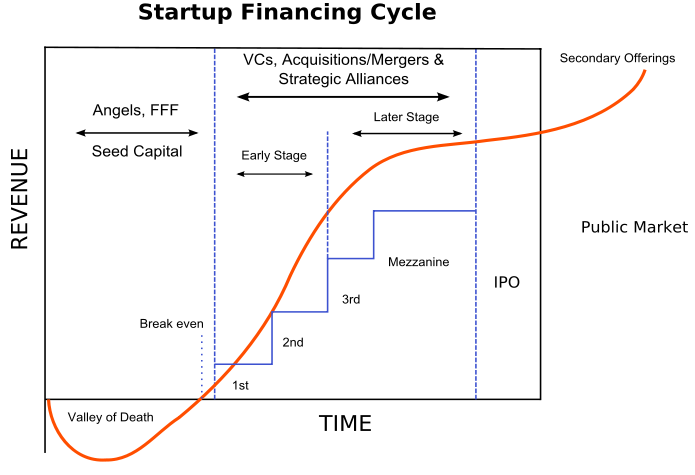

On the other hand, overall VC funding fell 53% year-over-year in Q1 202, to $76 billion. But investors still hold a record $580 billion in dry powder. Despite everything, investors are deploying capital at a slower pace in 2023 than seen in previous years. The uncertain economy has particularly slowed growth in ecommerce, cryptocurrency, and blockchain sectors.

So, what does this all mean for you as a wide-eyed startup founder?

The funding for new startups exists, with dry powder in abundance. However, in order to get a slice of that funding, startup founders will need to be meticulously prepared to answer the tough questions about their business proposal and path to profitability.

At Inside.com, we’re here to help you navigate the complex landscape of launching a new business in 2023, and it all starts with your idea.

How to come up with an idea for your startup

Whether you seek to disrupt a slow-adapting industry or want to come up with something entirely innovative, all startup ideas must be able to address problems that need to be solved.

In a tighter economy, products and solutions that are ‘must-haves’ rather than ‘nice-to-haves’ will have lasting power, and will be more attractive to consumers and investors. Try to answer some of the questions below:

- What are consumers struggling with today?

- What are their unique comfort and pain points?

- How can this be solved with SaaS, ecommerce, or other solutions?

- How quickly can we address this problem?

Find a problem that people are willing to pay to have solved, and you've found a potential business opportunity.

Pay attention to the world around you and look for trends. What are people doing differently? What new technologies are emerging? What are the latest social and economic changes that are impacting lives? If you can identify a trend early on, you can be ahead of the curve.

Example: We’ve seen the disruptive nature of Generative-AI and how startups are building on top of language models to expedite sales cycles, create marketing assets, increase worker productivity, amongst many other things. This is just the latest trend in a long line of disruptive technologies solving business problems and inefficiencies.

5 ways to identify market trends

Looking inward to problems affecting your life and the lives of your friends, family, and network around you is one way to identify trends. But if you want to scale this research and take it to the next level, social media, online communities, and IRL events are great places to formulate your startup idea.

- Follow influencers and key personalities. Locate the high-profile personalities in your industry or target market and follow them on social media. Look at the content they are sharing, the topics they are discussing, and the engagement they are receiving. Look for common themes and questions people in their circles are discussing.

- Join online communities and start engaging. Be a part of the discussions taking place in your target market. Gather feedback from your prospective audience to understand their pain points and preferences on a deeper level. Running polls, surveys, and other market research methods can provide you with hard data to reference.

- Monitor potential competitors and find gaps. Many startup ideas today sought to pick up where competitors dropped the ball. One of the best ways to identify gaps in a competitive solution is to read customer reviews. Are there patterns in unmet needs? Are customers actively seeking another solution? What are some ways you can provide an overall better user experience? Don’t neglect the positive reviews either! These features can be tablestakes when starting your business. There’s even a way to use AI chat to connect you with specific products based on their customer reviews. This can help speed up the research process if you already have a SaaS category in mind.

- Attend industry events and make your voice heard. Supplement your online activity with going out and validating your idea in person. Here you can meet potential customers, partners, and advocates. It’s also a great way to learn more about the industry you’re operating in. In the age of remote work, nothing beats in-person collaboration as a first-time founder.

- Finally, don’t ignore market reports in your research. These provide valuable insights into the size of the market, the competition, and target audiences. You can use this to make informed decisions about the product or service to offer, your pricing model, and your go-to-market strategy.

Market reports can also help to identify potential risks and opportunities in the market. For example, if the market is growing rapidly, it may be a good time to launch a new product or service. However, if the market is saturated, you may want to hit the drawing board to find your market-fit. This will help you later when trying to raise capital.

How to write & format your business plan

You’ve done your homework and extensively researched your market, now it’s time to compile everything into a plan of action. Some founders would say this is one of the more daunting steps when starting a business. It’s when your idea stops being an idea, and starts becoming real. But don’t worry, we’ll guide you through it.

Start with your executive summary. This is the first thing potential investors will review when pitching your business, so it needs to be razor sharp. It should be clear, concise, and persuasive. It should summarize your business model, your target market, and your competitive advantage. Some other important questions you’ll need to answer are:

What is your mission? Are you addressing environmental issues, social issues, consumer needs, business efficiencies, technological challenges, and so on.

What is your unique value proposition? Where does your product fit in the current market? Who exactly are you targeting with your product or service?

What are your credentials as a founder? Why should you and your team be trusted? What is your background? Do you have the backing of other partners that improve your credibility?

Next, describe your products or services in enough detail where potential investors understand your solution, but you’re not rambling on. Remember, your idea may look and sound great in your head, but putting it into words can be challenging. Working with an advisor or consultant here can help.

Structure you marketing and sales strategy

In today’s crowded market, your product won’t pitch itself. You need a comprehensive marketing and sales strategy to bring to investors. Ask yourself the questions below when ideating your strategy:

- How will you reach your target market?

- What marketing channels will you use?

- Paid Search, social media, direct mail, influencer marketing, etc.

- How will you acquire and retain users?

- If you already have a waitlist, this is important to highlight in your business plan! Building hype as a founder in the earliest days of business, even before your minimum viable product, is a great way to get a waitlist going while building your minimum viable product.

- How will you price your products or services?

Describe your management team

You may opt to be a solopreneur, or you may have a co-founder by your side when building your business. Whichever path you choose, this should be discussed in your business plan. Go into brief detail about why you (and your founding team) should be trusted with capital.

We actually had a heated debate about whether or not it’s necessary to build with a co-founder in one of our latest community discussions, check it out! Some agree that it could increase your chances of getting funding, others say too many cooks in the kitchen could derail your vision. We’ll leave you to decide.

Outline your financial projections

This may be the most important part of your business plan. You can sell the vision until you’re blue in the face, but if the financials don’t make sense for an investor, you’ll find it difficult to get funding.

Be sure to provide a high-level overview of your financial projections – including revenue, expenses, and path to profitability. Be realistic and transparent about your assumptions and risks, and how much you’ll need to raise.

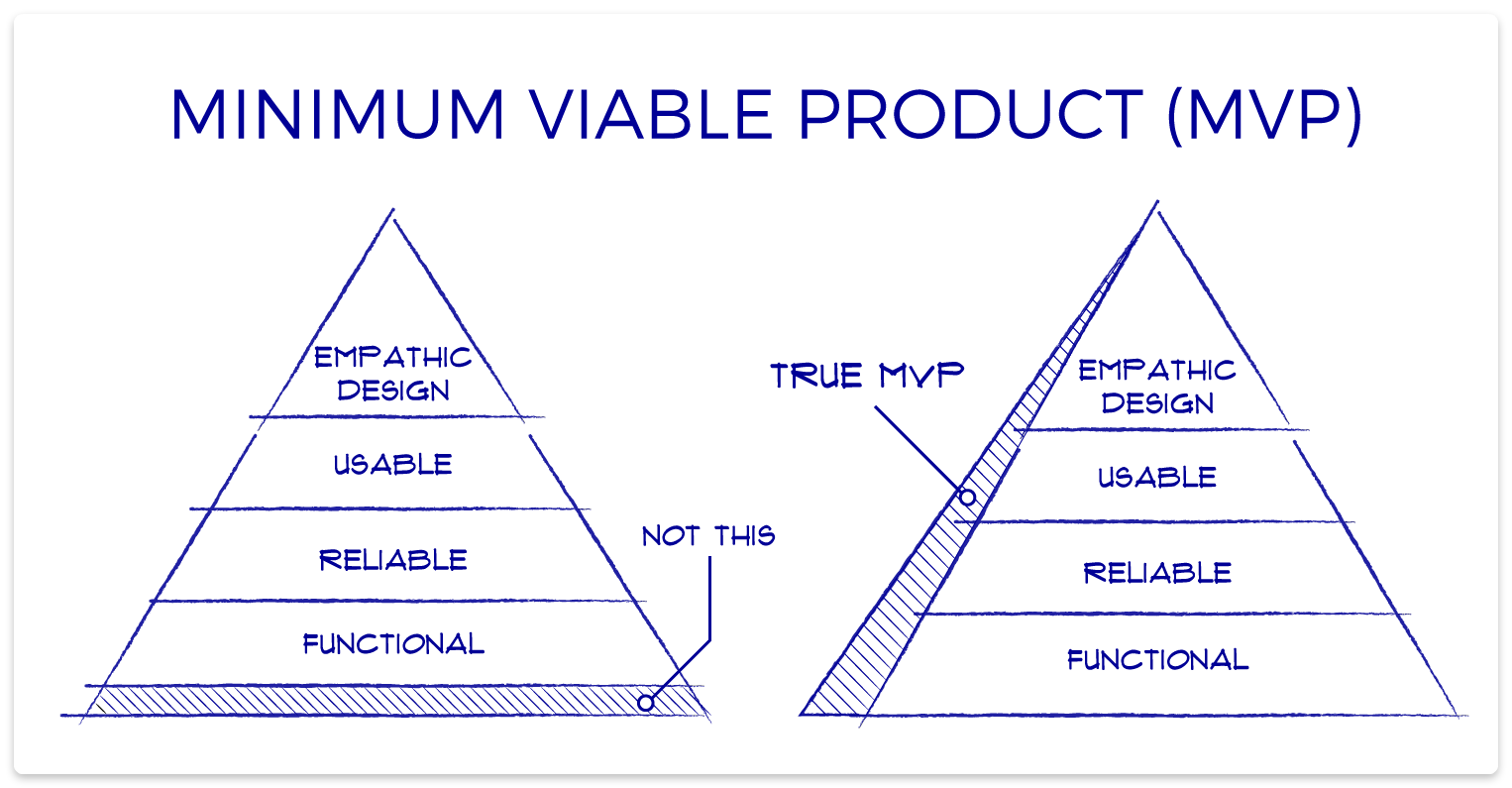

How to build your minimum viable product

As Seth Godin once said, “waiting for perfection is never as smart as making progress.” Apply this same concept to your startup idea. Waiting for perfection can lead to missed opportunities. Markets are constantly changing, and if you're not there to capture the opportunity, someone else will be. This is especially true today where Generative-AI, no-code solutions, and the abundance of outsourced talent make launching a product faster than ever.

Perfection aside and your playbook at hand, now you’re ready to build your minimum viable product (MVP).

The development process

While MVPs aren’t complete products, they’ll need to be functional enough to present to a target audience and get feedback. If you or your co-founder aren't product-savvy, you may need to hire or outsource freelance design and development. But before doing this, you’ll want to:

Identify the core features. These are the features that are essential to your product’s functionality and that will help you test your idea. For example, if your startup idea is an AI-financial advice app, its chat function should be mostly working to handle basic conversations with app testers.

Create a prototype. With your core features in mind, create a prototype of your product. This can be a simple mockup, wireframe, or even a working model with limited functionality. Now is not the time to obsess about design or UI, just make sure it looks good enough to test!

The feedback process

The importance of getting feedback on your MVP can’t be overstated. It’s this feedback that will inform your roadmap for achieving product-market fit and getting investors to buy-in. Below are 5 of the most common ways to get feedback:

- Ask your friends and family. This is the simplest way to get early feedback on your product, and you may be surprised at how helpful your loved ones can be.

- Reach out to your target audience. If you know who your ideal customer is, you can reach out to them directly and ask them to test your product. You can do this through social media, email, or even cold calling.

- Use online communities. There are many online communities where you can find people who are willing to test new products. Inside.com is a great place to find like-minded entrepreneurs in your field to request feedback from. Some other popular communities include Product Hunt, Betalist, and UserTesting.

- Run a beta test. A beta test is a great way to get feedback from a large group of people. You can run a beta test through your website, social media, or an online community.

- Offer incentives. If you're having trouble finding people to test your product, you can offer them incentives, such as free products, gift cards, or cash.

Keep in mind, getting feedback on your MVP takes time. Don't expect to get it immediately. Be patient, and be specific about what you’re looking for with your testers. Do you want comments on the design, the features, or the overall usability? Run additional feedback sessions until you have a good understanding of what people think of your product.

Applying your feedback

You’re almost there, but you’ll first need to apply feedback you just received and then go through another cycle. This will help add the finishing touches to your product and give your team confidence before going to market.

Remember, not all feedback is equal, so you should prioritize tester feedback based on demographics that most closely align with your target user. For example, feedback from your cousins is fine, but feedback from an influential member on an online community may carry more weight.

After categorizing your feedback, make sure you quantify and analyze it. This is where you’ll acquire hard data for your pitch deck. Using our AI-financial advice app example from earlier, this data may say “82% of testers said they felt more confident making financial decisions after using the app.”

Not everything at the end of your MVP cycle needs to be perfect, nor does your product need to have all of its desired features yet. But in order to go to market confidently, apply and test the changes made to your app based on the feedback you received. Address bugs in your MVP and fine tune the UX/UI so everything works smoothly and efficiently. And then run through another feedback cycle to ensure that the changes are working as intended.

How to achieve product-market fit

It’s important to preface that product-market fit is a journey rather than a destination. At this point, you may think you have all the pieces in place, but you’ll continue to adjust your product strategy once you go to market and unveil new findings. Your research in step one of this guide plays to your advantage here, but always be receptive to feedback.

Once you go to market, you should look out for general signs that you may have achieved product-market fit. Some of these include:

- Your product is solving a real problem for your target market.

- Your users are raving about your product.

- Your paying users are growing.

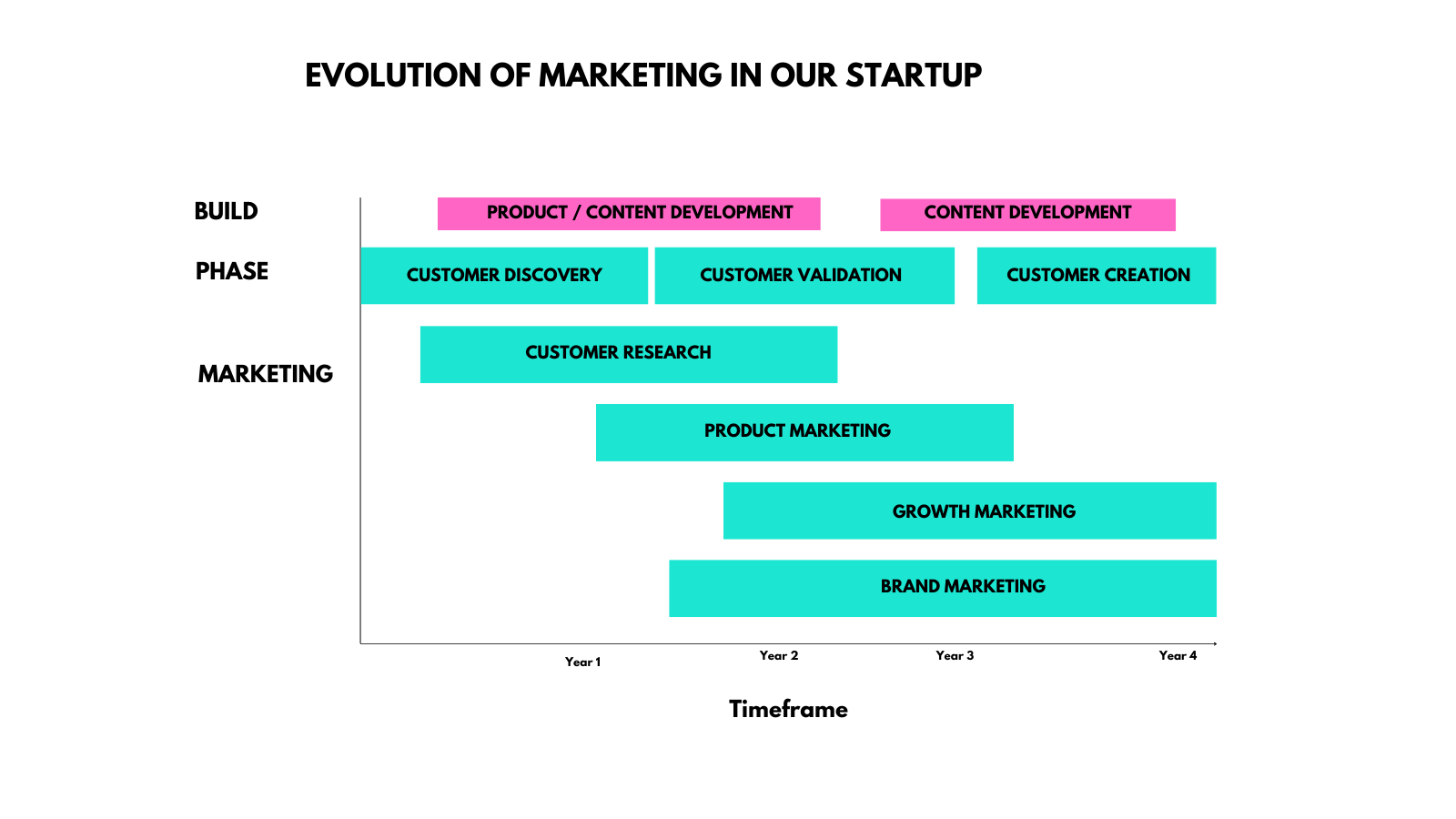

Operationalize your marketing

Another important aspect of identifying product-market fit is momentum. Start putting into action your proposed marketing and sales strategies from your business plan in step two of this guide, and find momentum with your target market.

For example, if you find that a group of affiliate websites are passing on tons of users to your product, double-down on that strategy. Would those affiliates be willing to take a higher commission if you gave them goals for referring paying customers? Hiring an outside marketing strategist here can help find these opportunities for you.

Throughout this process, gather metrics that show your product is growing and people are willing to pay. Having paying customers can help you negotiate better terms with investors. If you can show that your business is already generating revenue and that you have a clear path to scaling it further, investors may be more willing to offer you better terms or a higher valuation. Which brings us to our final section.

How to search for investors

At this point, your startup is generating buzz.

You’re growing sign-ups and people are willing to pay for your early product. You feel you’ve found your fit in the market and have a business proposal for achieving growth and becoming profitable. If investor funding is something you’ve considered your team needs in order to keep scaling, read on.

Investors are an attractive option for startup founders who have tapped their savings, sweat equity, and other forms of financing, but where do you go about finding investors? There are several options today for you to consider.

Angel investors

An angel investor is an individual who provides capital to startups or early-stage businesses in exchange for ownership equity or convertible debt. These investors typically have a high net worth and are looking to support promising entrepreneurs while potentially earning a significant return on their investment.

Angel investors can be successful entrepreneurs themselves, business professionals, or even friends and family members – and there’s a good chance you’ve networked with angel investors in online communities or while attending events.

Why should I consider an angel investor?

Many angel investors have valuable experience and knowledge in your industry, making them excellent mentors who can offer guidance and advice.

They can also provide the initial capital needed to grow your startup, allowing you to hire more developers, other staff, and cover essential expenses.

Some prominent angel investor communities are Wellfound, Gust, and Angelsvc. You can check out our complete guide to angel investors if you feel this is right for you.

Venture capitalists (VC)

VCs are professionals who manage VC funds, pooling money from multiple investors to finance multiple businesses. They seek to generate a substantial return on their investment by nurturing and guiding the growth of these companies.

These investors can provide significant capital to scale your startup, allowing you to expand operations, enter new markets, and grow your team.

Online platforms like Crunchbase and PitchBook provide information on VC firms and their investments, allowing you to identify potential VCs interested in your industry or stage of development.

You should also ask other entrepreneurs, mentors, or industry professionals for referrals to VCs who may be a good fit for your startup.

Why should I consider a VC?

Many VCs have extensive experience in your industry, offering valuable insights and strategic advice to help your startup succeed.

VCs often provide resources and support beyond funding, such as introductions to industry experts, assistance with hiring key personnel, and access to tools and technology that can help your start-up grow.

If VC is a route that has your interest, join Inside.com’s VC community of thousands of industry experts and start making connections today.

Accelerators

An accelerator is a time-limited, cohort-based program designed to support and nurture startups by providing them with mentorship, resources, networking opportunities, and sometimes funding in exchange for equity.

Accelerators often provide startups with resources such as office space, tools, technology, and training, which can save costs and accelerate growth.

Why should I consider an accelerator?

Accelerators offer a structured, goal-oriented environment that can help you focus on achieving specific milestones, refining your business model, and setting a solid foundation for your startup’s growth.

If this organization-wide mentorship is important to you and your team, an accelerator may have your interest.

Some prominent accelerator communities are Y Combinator, Techstars, and 500 Startups. You can check out our top 12 accelerator programs to apply to learn more about this financing and growth option.

Don’t get discouraged

For every 20 startups that apply to accelerator programs, one gets accepted. Of the 4,000 startups that seek funding from top VC firms every year, only 200 get funded.

You’re going to apply and get rejected from many programs and investors throughout your early startup journey. This could put you on the fast-track to doubt and discouragement. “Are we actually building something great here,” you ask yourself.

Be open and receptive to feedback you’re getting. Learn from entrepreneurs and investors who have been there, done that, and understand the reasons why you’re getting turned down. Work this feedback into your business proposal from earlier and you’ll increase your chances at getting moved to the next round.

How to pitch to investors

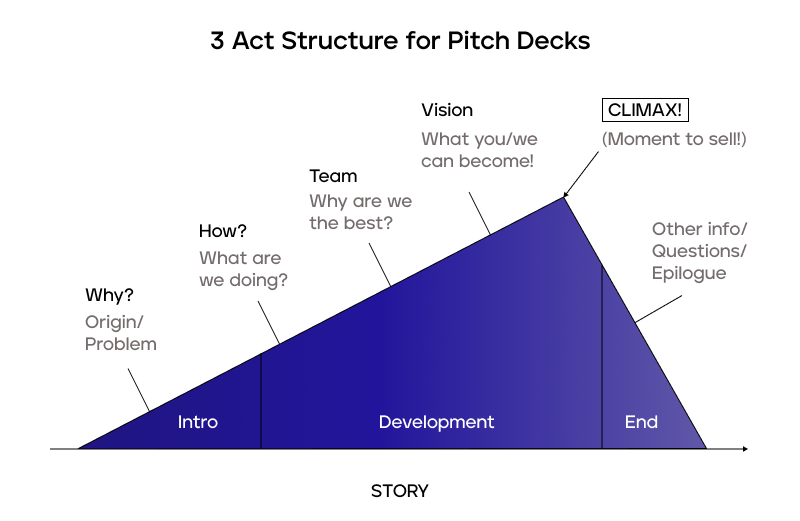

While going through rounds of screening and pitching sessions, there are ways to stand out amongst other startup founders. This final how-to section could help make your pitch more impactful and memorable for investors.

Do your due diligence. When reaching out to investors, make sure you understand what they're looking for in an investment. Read their investment thesis, analyze their portfolios, and talk with other founders who have raised money from them.

Remember, pitching is a two-way street. The more you know about who you’re pitching to, the more confident you’ll feel about receiving an investment. This also gives you insight into whether or not an investor and your business align well. You’ll want someone who understands your vision, can bring industry expertise, and be a key partner behind your growth.

Keep it short and sweet. Investors are busy people, so it’s good practice to deliver your business proposal in under 10 minutes. So keep rehearsing if you feel you’re rambling on and losing interest.

- What’s your business model?

- What’s your target market?

- Who is your competition?

- Who is the team behind your startup?

- What are your results so far? Having an MVP here proves your commitment to the product and can increase your chances of getting funded.

Be passionate. Investors admire founders who are passionate about what they're building. They want to see that you're excited about your startup and its potential. When pitching, be sure to articulate your vision for your startup and what gets you excited about it.

- Show enthusiasm. Speak with energy and confidence when talking about your startup. Let your passion for your product shine through.

- Get specific. Don’t just talk about your startup in general terms. Get specific about your vision for the future and what you hope to achieve.

- Be personal. Share a personal story or anecdote. Investors want to know that you’re all-in and willing to put in the hard work to make it a success.

Know what you’re asking for. How much money are you looking to raise and what will that money go toward? Investors want to know their money will be spent wisely and that they’re getting a good return on their investment.

- Do your homework. Research the amount of money that you’ll need to achieve growth. Talk with other founders who have raised money in the past or read about how much money similar companies in your industry have raised in recent quarters.

- Create a budget. Your financial projection outline in your business proposal should cover this section. Detail how you plan on using investor funds so they know it’s not going to waste.

- Be realistic. Don’t overestimate how much money you need. Investors prefer founders who are very intentional about their spending. Asking for too much may cause an investor to assume you’d be tempted to spend it on things that aren’t essential to the growth of your startup. Overvaluing your startup will also make it more difficult to turn a profit.

Be prepared to answer tough questions. Investors won’t hold back when it comes to feedback, especially in a tight economy like today. They may have a hesitation about your product-market fit, perhaps the amount of competition already flooding your target market affects their confidence in your product. Be prepared to face this criticism and skepticism head on. Acknowledge their concerns and address how you and your team plan on navigating the tough landscape.

Challenges you may face as a first-time founder

Few people pursue their passion in life like startup founders do, but this laser-focused mission doesn’t come without its challenges. According to Entrepreneur, building a meaningful business could take anywhere from 5 to 10 years. The amount of things that can go wrong in that timeframe would be longer than this guide, but let’s dive into some of the most common challenges most first-time founders will experience.

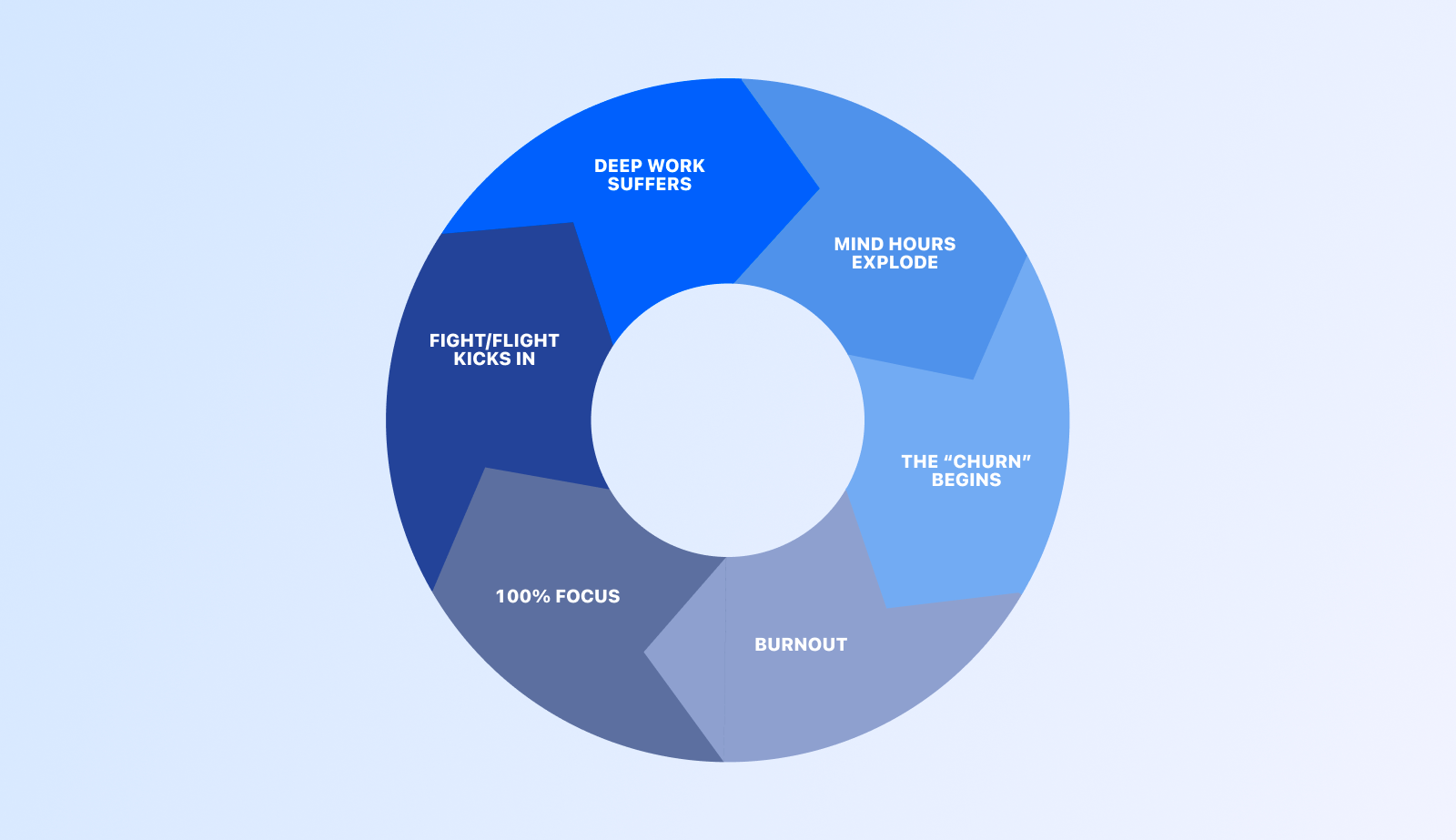

Burnout can affect your well-being

A reported 63% of founders say they are either burnt out or have experienced burnout recently. The stigmas surrounding entrepreneurs and mental health issues have made addressing burnout a difficult topic to discuss for founders.

Burnout can stem from so many things within your business.

- Your product is taking longer than expected to develop.

- You keep getting rejected for accelerator programs.

- You start doubting your credibility as a founder.

- The list goes on…

And then there’s burnout that comes from unpredicted life events, whether that’s with your family, friends, significant other, and so on. Burnout can set in quickly and come from many different angles in your life.

In a recent discussion on Inside.com, we sought insights from founders on how they’re addressing burnout. Here are two that resonated with us:

- Find a hobby outside of work. It’s easy to get consumed in your work-life. Finding something you’re passionate about outside of building your startup can take your mind off frustration. Sidney (Sid) Klein, CEO of SafeData.io, says his hobbies in film photography, NYT Sunday crosswords, rose cultivation, and wok cooking help him ease burnout.

- Be conscious of your work hours. On average, founders put about 80 hours per week into their business, some even hit triple digits. You’ll hit spurts of productivity and want to work without an end in sight. That’s fine. But doing this for months on end can lead to unhealthy working habits. Be aware of the hours you’re putting in if you’re starting to feel burnt out. Unplug and take time with your family, friends, and loved ones.

Hiring takes time, money, and commitment

Whether you received investor funding or bootstrapped, you’ll be tasked with hiring a starting team so the real growth can begin. But many founders will tell you that hiring is one of the most difficult things you can do in the early days, especially if you’re not from a recruiting background.

Hiring can be difficult for a few reasons:

- If you can’t offer competitive salaries and benefits, it can make attracting top talent very challenging.

- Employees may be hesitant to join a company that is not yet profitable or has not yet proven itself in the market.

- Early-stage startup founders often lack the experience and skills necessary to hire and manage employees. They may not know how to write job descriptions, interview candidates, or make proper hiring decisions.

We asked founders who their first three hires would be. While there are tons of different routes to go based on the skills you possess as a founder (and your co-founder), general themes included:

- CPA to keep your books in check.

- Growth Hacker to automate systems and scale them quickly.

- Attorney to protect your assets from day one.

- CS leader to learn your customers and success patterns deeply.

- CMO to be the marketing face of your brand, and build hype.

Issues with cash burn

Cash flow is the lifeblood of your startup. If you’re burning cash at an unsustainable rate, your startup is at greater risk of shutting down. While this is the worst case scenario for your startup, there are other issues that come with cash burn.

- Not being able to raise more money. Even if a startup has enough money to operate in the short term, it may not be able to raise more money in the future. This could be due to a number of factors, such as a lack of investor interest or a poor business model.

- Having to make difficult decisions. When a startup is running out of money, it may have to make difficult decisions, such as laying off employees or cutting back on expenses. These decisions can be difficult and may have a negative impact on morale and productivity.

- Losing focus. Focusing on short-term fixes, such as cutting costs or making unfavorable quick deals with customers, can lead to bad decisions that could hurt your startup in the long run.

Keep your overhead costs and payroll expenses as low as necessary in the early days of your startup. Seek expert contractors or freelancers as a stop-gap to hiring full-time talent. And finally, don’t lose sight of your vision, your market-fit, and your financial plan. Hiring the right team can help immensely here.

Lessons learned from other startup founders

As we wrap up this guide, we want to share advice from founders in our startup community who have gone through the growing pains themselves.

Hire the best people based on their experience and abilities without worrying about specific job titles they've had.

"The talent that will take your company to the next level has “experiential intelligence” from everything they’ve done in life – from their work to volunteering to cross-cultural travel to hobbies and more. Look at how people think in terms of their mindsets and and what they possess in terms of their broader abilities." – Soren Kaplan, Co-Founder at Praxie.com

The biggest lesson I've learned is realizing that entrepreneurship is full of testing, trying and learning.

"That naturally means that our journeys are dotted with more failed trials than successful ones. Learning to embrace (and even enjoy) these failed trials is the key to reaching small wins (because big wins are a myth)." – Mugdha Hedaoo, Founder & CEO at GoPlay Cosmetics

Guard your time and energy carefully. It's your most valuable resource in the early stages of building your company.

"There are seemingly unlimited things to do and people to meet, but it's worth being thoughtful and intentional with where you put your attention. It will pay off in the long run." – Dan Giuliani, Co-Founder & CEO at Volt Athletics

Disclaimer:

This content is for informational purposes only, and is not a recommendation of an investment strategy or to buy or sell any security, digital asset (including cryptocurrency) in any account. The content is also not a research report and is not intended to serve as the basis for any investment decision. The content is not legal advice. Any third-party information provided therein does not reflect the views of Inside.com. All investments involve risk including the loss of principal, and past performance does not guarantee future results.